Are You Ready For GST Implications On Supply Chain?

Taxation system has a significant impact on supply chain design of organizations. At present, the logistics decisions are taken based on the taxation system rather than to optimize the operational efficiency. Organizations prefer to have warehouses in each state where it is doing business. In such a scenario, the interstate movement of goods is considered as internal stock transfer and hence CST is not levied. This arrangement has led to an inefficient network of warehouse adding additional cost on the balance sheet of companies.

It is important for companies to understand the GST implications on supply chain and reassess whether their supply chain network is GST ready. Read on to know more.

GST will bring major changes in the way procurement, warehousing and transportation are carried out in India. Supply chain networks will be designed considering cost and lead times and state boundaries and state level taxes will lose their relevance. Warehouses of most of the organizations are expected to consolidate by 20 % t0 30 % whereas the average size of trucks for transportation will see an increase.

Most of the above decisions have long-term impact and are capital intensive. These transitions may take a period of 1 year to 3 years. Therefore, if you are yet to figure out the GST implications on supply chain, you may be critically short of time.

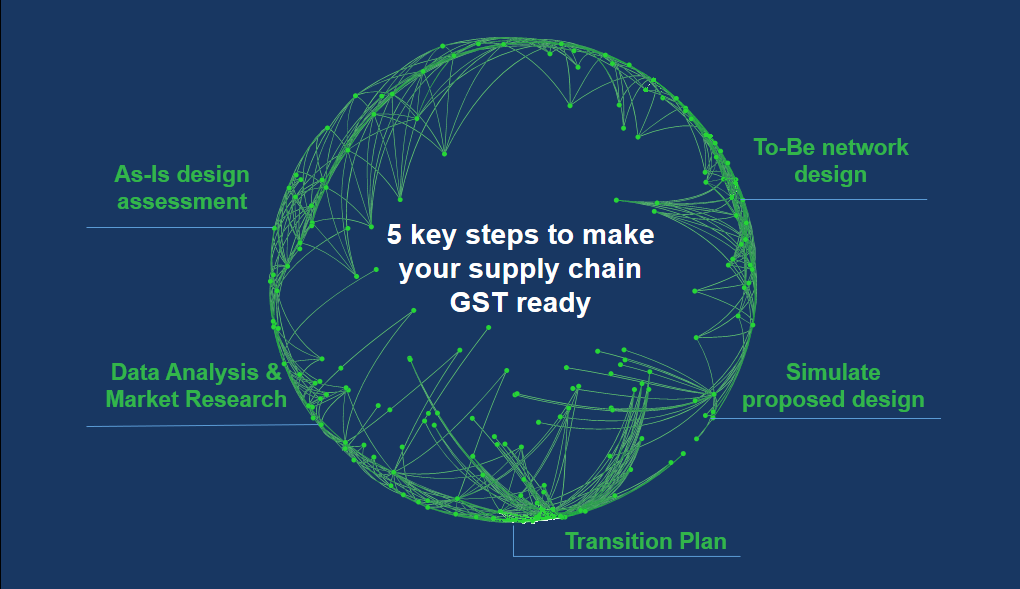

Holisol’s 5 step network re-engineering process can help you in timely planning taking into consideration the GST implications on supply chain:

a. As-Is Design Assessment – Map your current manufacturing, warehousing and dealer footprints. Map current processes and current routes to identify the constraints. Do a detailed gap analysis considering GST scenario and identify the changes that will make your operations more efficient.

b. Data Analysis & Market Research – Gather data about current business processes like lead-time, loss of sales and delays. Analyze the data to understand areas of improvement and understand the key drivers that can help you create a more efficient supply chain ecosystem for your organization.

c. To -Be Network Design – Based on the observations in first two steps, create a baseline model for logistics design. Define all the assumptions you have made in your model and get it validated with internal and external stakeholders. Based on the model, prepare network designs depending on resource availability, required investment and customer’s requirements.

d. Simulate proposed design – Create “what-if” supply chain scenarios and simulate the network designs for lead-time and cost. Do a cost-benefit analysis to see if the proposed changes in the network are beneficial in the long run. Finalize the network design based on the above simulation results.

e. Transition Plan – Create a list of all activities required for the transition and allocate cost and timelines for each of the activities. Develop phase wise implementation plan so that the current operations are not affected. Create SOPs, process maps, and manuals for all the changes and train employees for the changes.

Reassessing and redesigning your supply chain for GST can be a time-consuming exercise. It is important for organizations to assess GST implications on supply chain at the earliest and start working on a transition plan. If you are not yet GST ready, Holisol’s five-step approach can help you to plan your supply chain transition in a systematic way. GST is expected to reduce supply chain cost of organizations between 2 % to 8 %. Therefore, it is important that you analyze the GST implications on supply chain well and create a strategy to take benefits on India’s biggest tax reform. For more information email us at [email protected]